Easy Ways to Spot Suspicious Calls from Those Claiming to be the IRS

With tax season in full swing, phony IRS calls are more frequent than usual. It’s important to stay apprised of the scams and how they can illicit your personal information for financial gain. Due to the importance of maintaining compliance with IRS requirements, most people are quick to hand over their information. Doing so can result in your identity being compromised and the resolution for such requires an incredible amount of work to resolve. It is particularly dangerous for business owners as your livelihood can be stripped from under you overnight.

With tax season in full swing, phony IRS calls are more frequent than usual. It’s important to stay apprised of the scams and how they can illicit your personal information for financial gain. Due to the importance of maintaining compliance with IRS requirements, most people are quick to hand over their information. Doing so can result in your identity being compromised and the resolution for such requires an incredible amount of work to resolve. It is particularly dangerous for business owners as your livelihood can be stripped from under you overnight.

The IRS offers some great tips for vetting the calls and discerning phony from real calls.

The first is an understanding for what they are typically using as bait. They may demand money, or say you are due money. They likely will know a significant amount of your personal information and mask their phone numbers from the IRS. Some will go one step further and provide fake names and IRS identification numbers.

The IRS Commissioner, John Koskinen states “We have formal processes in place for people with tax issues. The IRS respects taxpayer rights, and these angry, shake-down calls are not how we do business.” According to the IRS website, there are 5 things the IRS will never do:

- Call to demand immediate payment, nor will we call about taxes owed without first having mailed you a bill.

- Demand that you pay taxes without giving you the opportunity to question or appeal the amount they say you owe.

- Require you to use a specific payment method for your taxes, such as a prepaid debit card.

- Ask for credit or debit card numbers over the phone.

- Threaten to bring in local police or other law-enforcement groups to have you arrested for not paying.

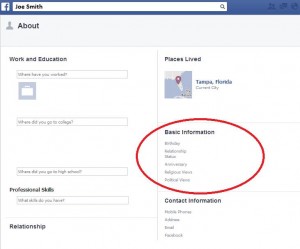

The IRS does not use unsolicited email, text messages or any social media to discuss your personal tax issue. One way to ensure that you are up to date on taxes is to work with a PEO – they will make sure that you are following the correct codes, regulations and tax requirements. Contact us today to find out which PEO is right for you!