Who Can Benefit from a PEO?

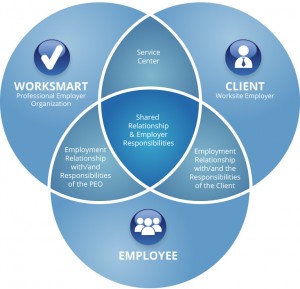

One of the great elements of PEOs is that they are valuable to businesses across a myriad of industries. Utilizing a PEO can yield incredible benefits like cost savings, reduced overhead, optimized human resources functions and increased productivity in other areas of the business.

One of the great elements of PEOs is that they are valuable to businesses across a myriad of industries. Utilizing a PEO can yield incredible benefits like cost savings, reduced overhead, optimized human resources functions and increased productivity in other areas of the business.

PEOs can handle everything from basic HR functions like payroll processing and benefits to complex items like OSHA compliance and workers compensation insurance. They are also able to support your business in the creation of employee conduct protocols and other HR policies.

There are quite a few businesses and industries that can benefit from PEOs. Small to medium sized businesses are ideal candidates for engaging with a PEO. Generally the HR functions are managed by a single individual or the business owner which can take away significant amounts of time from hiring, employee development and running the business.

Particular industries also benefit greatly from utilizing a PEO to support their human resources functions. The first of which are industries like trucking, construction and moving businesses that tend to pose a higher risk as it relates to work related injuries, employee turnover and scheduling challenges. Given the high risk of the business and the significant regulatory compliance that is required, outsourcing these functions to a PEO not only frees up time but also reduces risk.

Other high risk businesses that would benefit from PEO services include medical practices and dental practices as they also deal with high levels of ever changing regulatory compliance. Obtaining a PEO who specializes in medical and dental services will help ensure that you maintain HIPPA, ACA and other regulatory compliance.

Contact us today to find out how PEO services can support your business operations!